Table of Content

Home Development Finance Corporation Ltd has hiked its Retail Prime Lending Rate by 35 basis points with effect from December 20, 2022. HDFC home rates to start from 8.65 % onwards for credit score of 800 & above. Your contributions are pooled in a pension fund and the savings are managed by professional fund managers. HDFC Pension Management Company Limited, who invests in diversified portfolios - government bonds, bills, corporate debentures, shares etc. These contributions would grow over the years and depending on the investment type, returns are earned.

I declare that the information I have provided is accurate and complete to the best of my knowledge. “The maximum period of repayment of a loan shall be up to 30 years for the Telescopic Repayment Option under the Adjustable Rate Home Loan. For all other Home Loan products, the maximum repayment period shall be up to 20 years," HDFC Ltd has said on its website. Potential IDBI Bank bidders have asked the government for tax benefits from the accumulated ₹45,000 crore losses to accrue to the acquiring entity in case the lender is merged with another bank.

HDFC Home Loan Application Form.

A preferential interest rate is offered to women customers. Women customers, irrespective of occupation, are offered preferential interest rates. No prepayment charges are levied on floating interest home loans as per RBI guidelines.

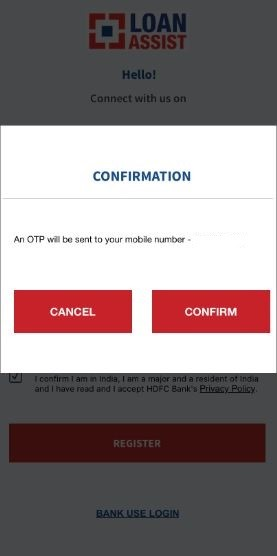

On the contrary, applicants with a reasonable credit score can easily secure an affordable home loan with the bank. You will be taken to the loan application form where the details you have already provided will be prefilled. Fill in the balance details – your date of birth and password and click on ‘Submit’. If you have shortlisted a property, click on ‘yes’ in the next question and provide the property details ; if you haven’t yet decided on the property, select ‘no’. If you want to add a co-applicant to your loan application, select the number of co-applicants (you can have a maximum of 8 co-applicants). For home loan approval, you need to submit the following documents for all applicants / co-applicants along with the completed and signed home loan application form.

Can I prepay my outstanding housing loan amount?

The contribution can be made by you upon opening an account with HDFC. The account opening process can be completed by submitting the application form along with the list of documents. A Permanent Retirement Account Number will be allotted to you through which you can start contributing to the NPS scheme to accumulate the corpus for retirement during working life. On retirement a portion of the accumulated corpus needs to be invested in the Annuity to get monthly pension. If you choose to disclose any personal information for or while availing the CIBIL Score/Report, you should be authorized to provide such information.

Check with the lender if the property that you have shortlisted will be considered for a housing loan. Improve your credit score by creating a reasonable track record of timely repayments so that you achieve a high credit score which would improve your prospects of getting a home loan. You can download account statements, interest certificates, request for home loan disbursement and do much more. Our chat service on our website and WhatsApp are available 24X7 to assist you with your housing loan related queries.

Combination Loans

HDFC is India’s premier housing finance company offering a wide range of home loan products that are customized to your needs and can be comfortably repaid over a longer tenure. HDFC’s end-to-end digital home loan application process, integrated branch network across the county and 24X7 online assistance can make your home owning journey a memorable one. There are the regular adjustable rate loans which are also known as a floating rate loan. The rate of interest on these loans can be adjusted throughout the loan tenure as per the bank discretion.

Post the fixed rate tenure, the loan switches to an adjustable rate. Home loan providers usually charge a processing fee around 0.5% of the loan amount to be availed. Choose a home loan provider who is transparent w.r.t. processing fee and other related charges. Read the FAQs before starting your loan application process. HDFC bank is one of India’s most reputed and trusted banking companies.

When can I take disbursement of the home loan?

If you purchase an under construction property you are generally required to service only the interest on the loan amount drawn till the final disbursement of the loan and pay EMIs thereafter. In case you wish to start principal repayment immediately you may opt to tranche the loan and start paying EMIs on the cumulative amounts disbursed. They can be floating rates of interest or even a mixed rate. According to the type, the EMO of your home loan will be fixed. Check your loan eligibility online before starting the application process. HDFC provides a facility to apply online for a home loan through a secured platform on the website that customers can access from the comfort & safety of their homes or office.

The RBI has increased the benchmark rate by a total of 2.25% since May as a consequence. Analysts projected that EMIs would increase as a result, and today's statement by HDFC came following the RBI's policy repo rate decision in December. Very fast, easy systematic application for home loan applying. Till now, I am highly satisfied with the services provided by HDFC. Definitely I will recommend HDFC for home loan requirement.

Opt for a home loan provider who offers longer tenure loans, flexible repayment options etc. Interest rates may differ depending upon the loan amount, profession (salaried or self- employed) and your credit score among other factors. In an adjustable or floating rate loan, the interest rate on your loan is linked to your lender’s benchmark rate. Any movement in the benchmark rate will effectuate a proportionate change in your applicable interest rate.

Processing fees for home loans are typically in the range of 0.5% of the loan amount at HDFC Ltd. Online system for approval is good with no time losses and with less travel with due verification. Before proceeding further you should have verified that the laws of your country/jurisdiction applicable to you permit the usage of this website from the country that you are accessing the website from. HDFC has not entered into any partnership, agency, tie-in and/or joint product arrangement with CIBIL. Loans for the purchase of properties from Development Authorities such as DDA, MHADA etc. Loans for construction on a freehold / lease hold plot or on a plot allotted by a Development Authority.

Currently, HDFC Home Loan interest rates start at 6.75% p.a. Housing Development Finance Corporation Ltd has revised its Retail Prime Lending Rate on housing loans. All the staff was supportive enough to get me through this entire process.

You can apply for a pre approved home loan which is an in-principal approval for a loan given on the basis of your income, creditworthiness and financial position. Generally, pre-approved loans are taken prior to property selection and are valid for a period of 6 months from the date of sanction of the loan . A home loan provisional certificate is a summary of the interest and the principal amounts repaid by you towards your home loan during a financial year. It is provided to you by HDFC and is required for claiming tax deductions. If you are an existing customer, you can easily download your provisional home loan provisional certificate from our online portal .

No comments:

Post a Comment